VA Home Loans: Exclusive Perks for Veterans and Active Duty Service Members

VA Home Loans: Exclusive Perks for Veterans and Active Duty Service Members

Blog Article

Navigating the Home Loans Landscape: Exactly How to Utilize Funding Solutions for Long-Term Wealth Building and Security

Navigating the intricacies of mortgage is essential for any person seeking to construct wealth and make certain financial protection. Understanding the different kinds of financing alternatives readily available, in addition to a clear evaluation of one's economic scenario, prepares for informed decision-making. By utilizing strategic loaning methods and maintaining property worth, individuals can enhance their long-term wealth capacity. Nonetheless, the details of efficiently using these options raise critical inquiries regarding the finest methods to follow and the pitfalls to prevent. What approaches can truly optimize your financial investment in today's unstable market?

Recognizing Home Loan Types

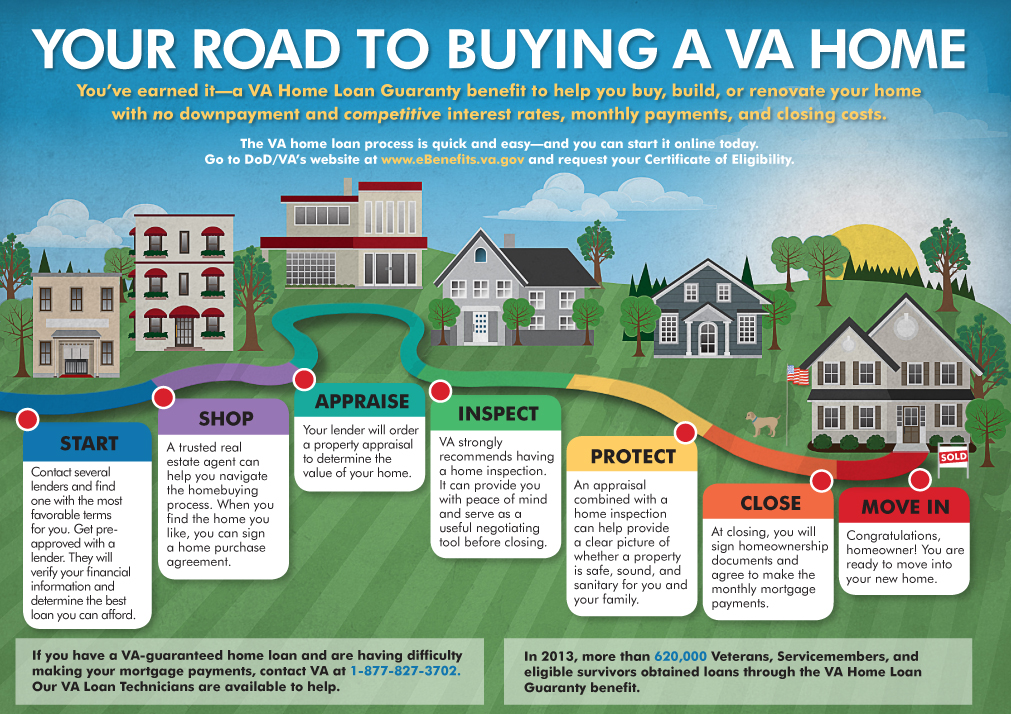

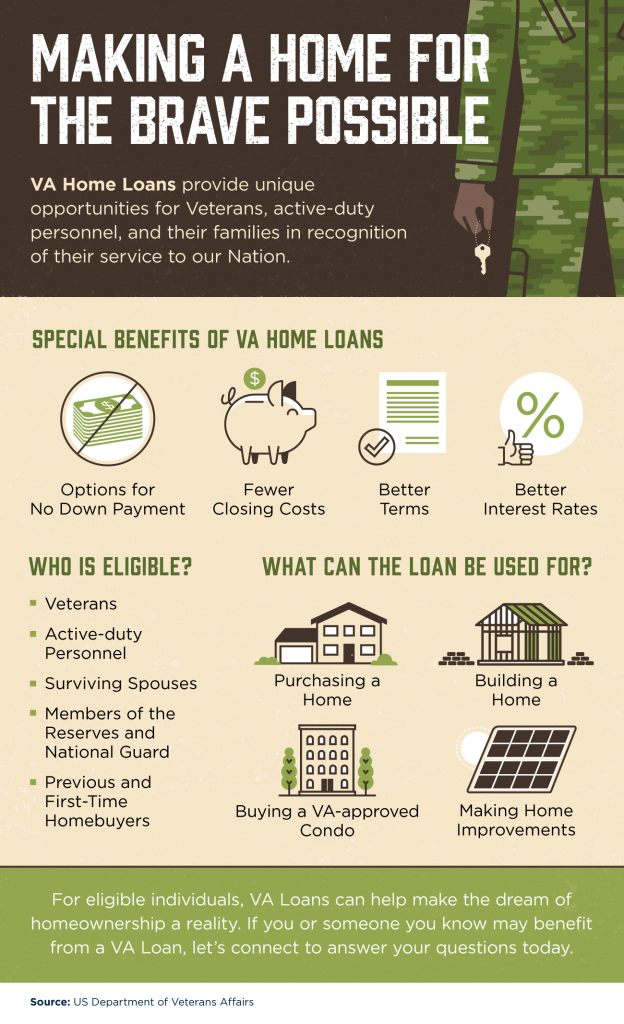

Home car loans, a crucial part of the realty market, come in various types made to satisfy the varied demands of debtors. One of the most usual sorts of home mortgage include fixed-rate home mortgages, variable-rate mortgages (ARMs), and government-backed financings such as FHA and VA lendings.

Fixed-rate home mortgages supply security with constant monthly settlements throughout the car loan term, commonly ranging from 15 to thirty years. This predictability makes them a popular choice for first-time property buyers. On the other hand, ARMs include rates of interest that fluctuate based upon market problems, typically causing lower first settlements. Nevertheless, borrowers should be gotten ready for potential increases in their monthly commitments over time.

Government-backed car loans, such as those guaranteed by the Federal Real Estate Management (FHA) or ensured by the Department of Veterans Matters (VA), cater to certain groups and often need lower deposits. These loans can assist in homeownership for individuals that may not get standard funding.

Examining Your Financial Situation

Assessing your economic situation is an important action in the mortgage procedure, as it lays the foundation for making educated borrowing choices. Begin by assessing your revenue resources, consisting of incomes, bonus offers, and any added revenue streams such as rental residential properties or investments. This comprehensive view of your revenues aids lending institutions identify your borrowing ability.

Following, examine your expenditures and regular monthly responsibilities, consisting of existing debts such as credit score cards, student finances, and car repayments. A clear understanding of your debt-to-income ratio is important, as most loan providers favor a proportion below 43%, guaranteeing you can take care of the new home loan repayments alongside your present commitments.

Furthermore, evaluate your credit report, which substantially impacts your financing terms and rate of interest. A greater credit rating shows monetary integrity, while a reduced score may necessitate techniques for enhancement prior to making an application for a car loan.

Lastly, consider your properties and savings, including emergency situation funds and fluid investments, to guarantee you can cover deposits and shutting costs. By diligently reviewing these elements, you will be much better positioned to navigate the mortgage landscape successfully and safeguard funding that aligns with your long-lasting financial goals.

Methods for Smart Borrowing

Smart borrowing is vital for browsing the intricacies of the home loan market successfully. To optimize your borrowing technique, begin by comprehending your credit profile. A strong credit report can significantly lower your rate of interest, converting to significant financial savings over the life of the lending. Regularly checking your credit scores record and attending to discrepancies can boost your rating.

Following, consider the type of home loan that finest fits your monetary situation. Fixed-rate lendings use security, while variable-rate mortgages might supply reduced preliminary repayments yet carry dangers of future price boosts (VA Home Loans). Examining your long-lasting strategies and financial capacity is important in making this choice

Furthermore, goal to protect pre-approval from lending institutions before home hunting. When making a deal., this not only provides a more clear photo of your budget plan however likewise strengthens your negotiating position.

Long-Term Wide Range Structure Techniques

Building lasting wealth via homeownership requires a tactical strategy that surpasses simply protecting a mortgage. One effective method is to take into consideration the admiration capacity of the home. Picking homes in expanding areas or locations with planned developments can result in considerable boosts in property value gradually.

One more vital facet is leveraging equity. As home mortgage payments are made, property owners develop equity, which can be tapped into for future investments. Making use of home equity car loans or lines of credit history intelligently can offer funds for added realty investments or renovations that check my blog further enhance home value.

Moreover, preserving the building's condition and making strategic upgrades can dramatically add to long-lasting wealth. Easy renovations like energy-efficient devices or modernized washrooms can yield high returns when it comes time to offer.

Last but not least, recognizing tax benefits connected with homeownership, such as home mortgage rate of interest deductions, can improve financial outcomes. By optimizing these benefits and embracing an aggressive investment way of thinking, house owners can cultivate a robust portfolio that cultivates long-term wealth and stability. Inevitably, an all-round method that focuses on both home option and equity management is necessary for sustainable wealth building description through property.

Keeping Financial Protection

Moreover, fixed-rate mortgages supply predictable regular monthly repayments, enabling much better budgeting and economic preparation. This predictability safeguards property owners from the fluctuations of rental markets, which can lead to abrupt increases in housing prices. It is important, nonetheless, to make sure that home mortgage repayments remain convenient within the wider context of one's financial landscape.

Additionally, responsible homeownership entails regular upkeep and enhancements, which secure property worth and enhance general safety. Homeowners ought to also take into consideration diversifying their economic portfolios, making certain that their financial investments are not entirely linked to property. By visit incorporating homeownership with other economic instruments, people can create a well balanced approach that alleviates risks and boosts general financial stability. Ultimately, maintaining economic protection via homeownership calls for a enlightened and positive strategy that highlights mindful planning and continuous persistance.

Verdict

Finally, properly browsing the home mortgage landscape requires a comprehensive understanding of numerous loan types and a comprehensive evaluation of individual monetary circumstances. Applying strategic loaning practices helps with long-term wealth accumulation and secures financial security. By keeping home value and deliberately making use of equity, house owners can produce opportunities for further financial investments. Inevitably, educated decision-making in financing options lays a durable structure for sustaining wealth and monetary safety.

Navigating the intricacies of home finances is vital for anyone looking to develop wealth and make sure financial security.Assessing your economic circumstance is an essential action in the home funding process, as it lays the structure for making informed borrowing choices.Homeownership not only offers as a car for lasting wealth building yet additionally plays a considerable duty in preserving economic security. By integrating homeownership with other economic instruments, individuals can develop a well balanced method that mitigates dangers and boosts total financial stability.In final thought, effectively navigating the home lendings landscape requires a detailed understanding of numerous finance types and a thorough assessment of private monetary circumstances.

Report this page